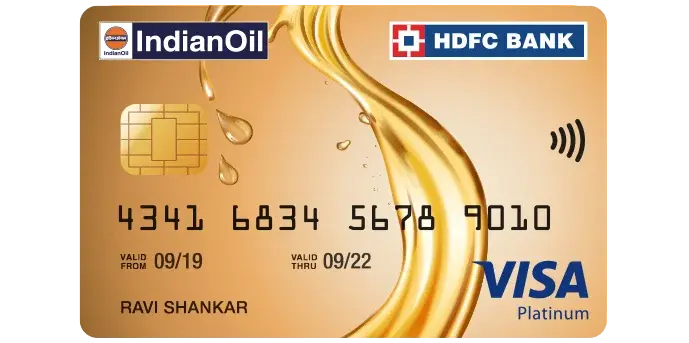

Indianoil HDFC Bank Credit Card

Rewards & Benefits

Welcome Benefits

None.

Milestone Benefits

None.

Cashback Rate

Users can redeem Fuel Points through NetBanking towards catalogue products where 1 FP = upto 20 paise. Effective cashback rate of 0.20%.

Customers will earn 5% Fuel Points of their spending as Fuel Points at IndianOil outlets. The value of 1 Fuel Poinbt is 0.96 Paisa. Effective cashback rate: 4.8%.

Movie Benefits

None.

Dining Benefits

None.

Other Benefits

Zero Lost card liability.; Fuel surcharge waiver is available.; Smart EMI option available.; Credit Card is enabled for contactless payments, facilitating fast, convenient and secure payments at retail outlets.

Lounge Access

None.

Rewards & Benefits

Welcome Benefits

None.

Milestone Benefits

None.

Cashback Rate

Users can redeem Fuel Points through NetBanking towards catalogue products where 1 FP = upto 20 paise. Effective cashback rate of 0.20%.

Customers will earn 5% Fuel Points of their spending as Fuel Points at IndianOil outlets. The value of 1 Fuel Poinbt is 0.96 Paisa. Effective cashback rate: 4.8%.

Movie Benefits

None.

Dining Benefits

None.

Other Benefits

Zero Lost card liability.; Fuel surcharge waiver is available.; Smart EMI option available.; Credit Card is enabled for contactless payments, facilitating fast, convenient and secure payments at retail outlets.

Lounge Access

None.

Fees & Charges

Joining Fee

Rs. 500/- + Applicable Taxes

Annual Fee

N.A.(Not Applicable)

Cash Advance Fee

Cash advance fee: 2.5% or ₹ 500 whichever is higher.

Interest rate

Interest Rates: 3.60% p.m. 43.20% p.a.

Late Payment Fee

Late Payment Charges: Less than ₹100 = Nil ₹100 to ₹500 = ₹100/- ₹501 to ₹5,000 = ₹500/- ₹5,001 to ₹10,000 = ₹600/- ₹10,001 to ₹25,000 = ₹800/- ₹25,001 to ₹50,000 = ₹1100/- More than ₹50,000 = ₹1300/-

Foreign Currency Transactions Fee

Foreign Currency Transactions Fees: 3.5%.

Other Fees

Joining/ Renewal Membership Fee – Rs. 500/- + Applicable Taxes | Reward Redemption Fees: Rs. 99/-

Fees & Charges

Joining Fee

Rs. 500/- + Applicable Taxes

Annual Fee

N.A.(Not Applicable)

Cash Advance Fee

2.5% or ?500 whichever is higher

Interest rate

Interest Rates: 3.60% p.m. 43.20% p.a.

Late Payment Fee

Late Payment Charges: Less than ₹100 = Nil ₹100 to ₹500 = ₹100/- ₹501 to ₹5,000 = ₹500/- ₹5,001 to ₹10,000 = ₹600/- ₹10,001 to ₹25,000 = ₹800/- ₹25,001 to ₹50,000 = ₹1100/- More than ₹50,000 = ₹1300/-

Foreign Currency Transactions Fee

Foreign Currency Transactions Fees: 3.5%.

Other Fees

Joining/ Renewal Membership Fee – Rs. 500/- + Applicable Taxes | Reward Redemption Fees: Rs. 99/-

Special Features

Customers can earn up to 50 Litres of free fuel annually.

Eligibility Criteria

For Salaried Indian National:

Age: Min 21 years to Max 60 Years,

Net Monthly Income> Rs 10,000

For Self Employed Indian National:

Age: Min 21 years & Max 65 Years

Annual Income: ITR > Rs 6 Lakhs per annum

Speical Feature, Eligibility and Benefits

How to apply for Credit Card?

Go to the HDFC Bank website.

Click on the "Credit Cards" tab.

Click on the "Apply for a Credit Card" button.

Select the "IndianOil HDFC Bank Credit Card" from the list of cards.

Enter your personal information, such as your name, address, and income.

Enter your PAN number and credit score.

Click on the "Submit" button.

A HDFC Bank representative will contact you to verify your details and complete the application process.

Contact Details

1800 202 6161 or 1860 267 6161,

send an SMS to 730 8080 808,

or even use WhatsApp to send a message to 707 0022 222.

Account Opening and Procedure

The card offers decent cashback on fuel. The card also comes with decent-value add features. Overall the card is must-have for individuals interested in fuel cost saving.

The card offers decent cashback on fuel. The card also comes with decent-value add features. Overall the card is must-have for individuals interested in fuel cost saving.

Abhijeet Saxena

Abhijeet Saxena

Nalsar University of Law

Ex- Senior Associate, Shardul Amarchand Mangaldas, Delhi

Ex - Khaitan & Co. Bengaluru,

Ex - National Stock Exchange, Mumbai,

Ex - Argus Partners, Mumbai