.webp)

Credit Card

Credit Card

Explore India's largest collection of unbiased credit card reviews. All credit cards reviews are unpaid and the rating provided by us is completely objective. Compare the pros, cons, special features and various fees associated with credit cards.

Credit Card

- Page 3

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Bank of Baroda

5

(APR) of 19.2%

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

BOB Assure Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

Bank of Baroda

Foreign currency transaction fee:A foreign currency transaction fee of 3.5% will be charged on all transactions made in a foreign currency.

(APR) of 19.2%

You earn 1 reward point for every Rs. 100 spent across all categories.

Redeem 500 points for ₹25. This translates to a value of 5 paise per point.

Effective Cashback Rate: 0.5% cashback on all spends.

5% cashback on fuel transactions.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

RBL Bank

5

3.99% p.m (upto 47.88% p.a).

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

RBL Bank Shoprite Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

RBL Bank

3.50%

3.99% p.m (upto 47.88% p.a).

The value of 1 reward point = INR 0.25. Users will get 1 reward point for every Rs.100 spent on all purchases except fuel and 20 reward points for every Rs.100 when using the card for in-store grocery shopping, effective in-store grocery shopping cashback rate: 5%. General cashback rate: 0.25%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

ICICI Bank

5

3.5% - 3.8%p.m. or 42% - 45.6%p.a.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Amazon Pay ICICI Bank Credit Card

.webp)

Bank / CC Company

Forex Mark-Up

Interest Rate

ICICI Bank

Foreign currency transactions: Mark-up of 3.50%.

3.5% - 3.8%p.m. or 42% - 45.6%p.a.

Reward system: The reward rate is 5% on Amazon for the cardholders if they are also an Amazon Prime member. Non-prime members will get 3% cashback on Amazon. 2% cashback on Amazon Pay for certain kinds of bill payments. 1% cashback on all other payments.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Union Bank of India

6.5

16% p.a.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

UNI Carbon Credit Card.

Bank / CC Company

Forex Mark-Up

Interest Rate

Union Bank of India

Foreign Currency Transactions Fees: 3%.

16% p.a.

The value of 1 reward point = 0.25.

For every Rs. 100 spent on non-fuel transactions, the cardholder will earn 2 reward points. Effective cashback rate: 0.50%.

1.50% cashback in the form of 6 payback points on transactions made on the HP Pay App.

16 rewards will be awarded on fuel spends with a minimum transaction of Rs. 500 and above at authorized HPCL outlets which would be equivalent to 4% cashback on every Rs. 100.00 spent up to a maximum of 150 per billing cycle per card.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Kotak Mahindra Bank

7.5

Interest Rate: 3.7% per month, 44.4% per year

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Myntra Kotak Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

Kotak Mahindra Bank

3.50%

Interest Rate: 3.7% per month, 44.4% per year

Users will get an instant discount of 7.5% on all spends done across Myntra Platforms (Mobile app/website) with a maximum discount of Rs.750 per transaction.

Cashback of 5% on spends across the Partner category of Myntra and Kotak Bank.

Earn unlimited 1.25% cashback on spending across all other online and offline merchants.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

HDFC Bank

0.15

3.60% p.m. 43.20% p.a.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

HDFC Bank Freedom Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

HDFC Bank

Foreign Currency Transactions Fees: 3.5%.

3.60% p.m. 43.20% p.a.

Users will get 1 reward point for every INR 100 spent.

1 CashPoint = Rs. 0.15 for redemption against product catalogue, SmartBuy, and cashback. Effective cashback rate: 0.15%.

1 RP for product catalogue 0.15. Effective cashback rate: 0.15%.

For unified SmartBuy (Flights/Hotels), the effective cashback rate is 0.15%.

10X CashPoints on Big Basket, BookMyshow, OYO, Swiggy & Uber. Special cashback rate 1.5%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

American Express

10

3.5% per month (42% p.a.)

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

American Express Smartearn Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

American Express

Foreign currency markup fee: 3.5% of the transaction amount for international transactions.

3.5% per month (42% p.a.)

The value of 1 RP=0.50 Paise.

10X Membership rewards on transactions on Zomato, Ajio, Nykaa, BookMyShow, Uber and many more. Effective cashback rate: 5%.

5X Membership rewards on transactions on Amazon and Paytm Wallet. Effective cashback rate: 2.5%.

1 Membership rewards point for every Rs. 50 spent except for spends on Fuel, Insurance, Utilites, Cash Transactions and EMI conversion at Point of Sale. Effective cashback rate: 0.50%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Bank of Baroda

5

3.49% per month

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Snapdeal Bobcard

Bank / CC Company

Forex Mark-Up

Interest Rate

Bank of Baroda

Foreign Currency Transaction Fee: 3.5% of transaction amount

3.49% per month

1 RP= INR 0.25.

5% Unlimited cashback (20 reward points per ₹ 100) for purchases on the Snapdeal website & app only.

10 reward points for every ₹ 100 spent on online shopping, grocery & departmental stores (Cashback rate: 2.5%),

4 reward points for every ₹ 100 spent on other categories (Cashback rate: 1%).

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

HDFC Bank

5

3.6% per month i.e. 43.2% annually

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

HDFC Bharat Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

HDFC Bank

Foreign Currency Transactions Fees: 3.5%.

3.6% per month i.e. 43.2% annually

In category A: Customers will get 5% monthly cashback when they book tickets through IRCTC. 5% monthly cashback on Fuel expenses and fuel surcharge waiver also available. 5% monthly cashback on spends on groceries. 5% monthly cashback on Bill payment and Mobile recharge.

In category B: 5% monthly cashback on spends on PayZapp/EasyEMI/SmartBUY.; Maximum cashback per month for categories A and B is Rs 300.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

HDFC Bank

3.33

1.99% monthly, 23.88% annually.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

HDFC Biz Black Metal Edition Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

HDFC Bank

Foreign currency markup: 2%.

1.99% monthly, 23.88% annually.

Reward System: 1 reward point = Upto Rs. 1.

5% cashback on selected business spends such as (a) Bill payment via Payzapp & SmartPay, (b) Income Tax/ Advance tax payment via eportal.incometax.gov.in, (c) GST payment via payment.gst.gov.in, (d) hotel & flight booking on MMT MyBiz by SmartBuy BizDeals, (e) business productivity tools like Tally, Office 365, AWS, Google, Credflow, Azure & more via SmartBuy BizDeals - Nuclei.

5X Reward Points applicable on minimum spends INR 50,000 in statement cycle.

A minimum of 2500 RP is needed to redeem reward points against the statement balance.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Yes Bank

4.5

2.99% per month (35.88% annually)

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

YES Bank Marquee Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

Yes Bank

Foreign Currency Mark-up of 1%

2.99% per month (35.88% annually)

1 YES rewardz point = Rs. 0.25.

Users will earn 36 YES reward points for every Rs. 200 spent on online shopping. Effective cashback rate: 4.5% (Online shopping).

Users will earn 18 YES rewardz points for every Rs. 200 spent on offline shopping. Effective cashback rate: 2.25% (Offline shopping).

Users will earn 10 YES rewardz points for every Rs. 200 spent on select categories (rentals, wallet loading, recharges & utility bill payments, insurance and government payments). Effective cashback rate: 1.25% (All other categories).

Users will earn 2 bonus reward points for every Rs. 100 spent on international transactions.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Axis Bank

3.2

Interest Rate: 3.6% per month (52.86% per annum).

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Axis Bank Rewards Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

Axis Bank

Forex Markup: 3.5%

Interest Rate: 3.6% per month (52.86% per annum).

Get 2 Edge reward points on spend of INR 125.

Value of 1 reward point = 0.20. General cashback rate = 0.32%.

Get 20 reward points on spending INR 125 on apparel and departmental stores. Apparel and departmental stores cashback rate: 3.2% (subject to a cap of 1008 points per month).

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Axis Bank

4

3.6% per month (52.86% per annum)

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

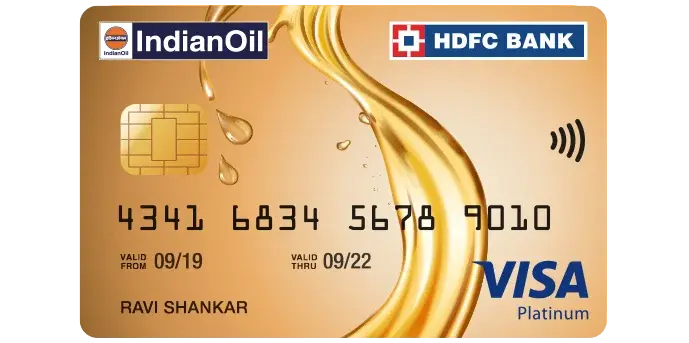

IndianOil Axis Bank Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

Axis Bank

Foreign currency transaction fee: 3.5% of the transaction value

3.6% per month (52.86% per annum)

Users can earn 20 reward points for every INR 100 spent on fuel. The value of 1RP= 0.20 paisa. Fuel cashback rate: 4%.

5 reward points for every INR 100 spent on online spending. Online cashback rate is 1%.

10% cashback at Myntra, Uber & Zomato, up to Rs 300 each per month.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

Kotak Mahindra Bank

4

Interest Rate: 3.5% per month, 42% per year

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Indianoil Kotak Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

Kotak Mahindra Bank

3.5% on the transaction value

Interest Rate: 3.5% per month, 42% per year

Reward System: The value of 1 RP = INR 0.25.

User will earn 24 reward points on every INR 150 spent, fuel cashback rate: 4%. Cardholders also get 2% cash back on grocery and dining spending. 0.5% cashback on all othe spends (uncapped).

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

State Bank of India

3.75

3.50% per month (42% per annum) from the transaction date.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Spar SBI Card Prime

Bank / CC Company

Forex Mark-Up

Interest Rate

State Bank of India

3.50%

3.50% per month (42% per annum) from the transaction date.

15 points on every INR 100 on online & retail landmark stores (Lifestyle, Home Centre, Max and Spar). Value of 1 point = INR 0.25 Effective store cashback rate: 3.75%.

Get 10 points on spend of every INR 100 on dinning, movies & entertainment spends. Effective dining/entertainment cashback rate: 2.5%.

Get 2 reward point per INR 100 spent on other retail purchases (Non fuel). Effective general cashback rate: 0.5%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

State Bank of India

3.75

3.50% per month (42% per annum) from the transaction date.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Lifestyle Home Centre SBI Card Prime

Bank / CC Company

Forex Mark-Up

Interest Rate

State Bank of India

3.50%

3.50% per month (42% per annum) from the transaction date.

Users will get 15 points on spending every INR 100 on online & retail landmark stores (Lifestyle, Home Centre, Max and Spar).

Value of 1 point = INR 0.25.

The effective store cashback rate is 3.75%.

10 points on every INR 100 on dining, movies & entertainment. Effective dining/entertainment cashback rate: 2.5%.

2 reward points per INR 100 spent on other retail purchases (Non-fuel). The effective general cashback rate: 0.5%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

IndusInd Bank

3

2.85% per month (34.2% per annum).

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

IndusInd Bank Club Vistara Explorer Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

IndusInd Bank

2.85% per month (34.2% per annum).

1 CV = Rs. 0.75.

On spending Rs. 200, customers will earn 8 CV points on the Club Vistara website. Cashback rate: 3%,

6 CV points on hotels, airlines, and other travel-related categories. Cashback rate: 2.25%,

2 CV points on utility bill payments, insurance premiums, government payments, and fuel purchases. Cashback rate: 1.5%.

1 CV point for all other categories of spending. Cashback rate: 0.75%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

State Bank of India

3.75

3.50% per month (42% per annum) from the transaction date.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Max SBI Card Prime

Bank / CC Company

Forex Mark-Up

Interest Rate

State Bank of India

3.50%

3.50% per month (42% per annum) from the transaction date.

15 point on spend of every INR 100 on online & retail landmark stores (Lifestyle, Home Centre, Max and Spar).

Value of 1 point = INR 0.25 Effective store cashback rate: 3.75%.

Get 10 points on spend of every INR 100 on dinning, movies & entertainment spends. Effective dining/entertainment cashback rate: 2.5%.

Get 2 reward point per INR 100 spent on other retail purchases (Non fuel). Effective general cashback rate: 0.5%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

State Bank of India

3

3.50% per month (42% per annum) from the transaction date.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

FabIndia SBI Card Select

Bank / CC Company

Forex Mark-Up

Interest Rate

State Bank of India

3.5

3.50% per month (42% per annum) from the transaction date.

Users will be awarded 10 points on spending every INR 100 on FabIndia stores.

Value of 1 point = INR 1. Effective FabIndia store cashback rate: 10%.

3 points on spend of every INR 100 on dining, movies & entertainment spends. Effective dining/entertainment cashback rate: 3%.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Credit Card Issuer

Most Useful Cashback Rate %

Interest Rate

Fuel Surcharge

HDFC Bank

5

3.6% per month i.e. 43.2% annually.

Cashback Rate

MyRupaya Ratings :-

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Indianoil HDFC Bank Credit Card

Bank / CC Company

Forex Mark-Up

Interest Rate

HDFC Bank

Foreign Currency Transactions Fees: 3.5%.

3.6% per month i.e. 43.2% annually.

Users can redeem Fuel Points through NetBanking towards catalogue products where 1 FP = upto 20 paise. Effective cashback rate of 0.20%.

Customers will earn 5% Fuel Points of their spending as Fuel Points at IndianOil outlets. The value of 1 Fuel Poinbt is 0.96 Paisa. Effective cashback rate: 4.8%.

- Page 1

- Page 1

- Page 1